Economics Package

The Economics Package consists of a collection of P# scripts and workflows for performing automated well-level economics calculations.

Overview

The Economics Package computes individual-well oil-field monthly cash flows for up to 40 years. These cash flows can be computed on existing wells and/or wells to be drilled in the future, and in addition to the monthly cash flow streams provides numerous KPI's such as NPV10, IRR, payout, life, etc.

These workflows are used in four applications:

- Completion Optimization

- A&D Candidate Screening

- A&D Corporate Cash Flow

- Asset Planning and Development

Regardless of the application, the same underlying scripts are run with the primary difference between applications being the entity sets (and related parent/hierarchy), effective dates, and possibly the numerous economics inputs.

In order to run these workflows several inputs are required to be loaded prior to running:

- Entity Set: The list of wells for running economics

- Economic inputs: Operating costs, NGL yields, ownership, etc.

- Well Cost Model: For cases where undrilled wells are included

- Commodity Prices: Hub oil & gas prices, NGL's as a % of Hub oil price.

Usage

Preparation

- Ensure that an appropriate hierarchy exists that contains all wells to be analyzed. All wells must have a parent of the same type (e.g., "Area").

Note

You must specify the name of the hierarchy you wish to use and the parent entity type by setting the workspace values EconomicsHierarchyName and EconomicsParentEntityType, respectively.

- Ensure that the workspace contains a hierarchy called "Cultural Hierarchy" that organizes wells under states/provinces and countries. An example of such a hierarchy would be

- United States (Entity type "Country")

- Texas (Entity type "State")

- Well 001

- Well 002

- Well 003

- Oklahoma (Entity type "State")

- Well 004

- Well 005

- Texas (Entity type "State")

- Canada (Entity type "Country")

- AB (Entity type "Province")

- Well 006

- BC (Entity type "Province")

- Well 007

- Well 008

- AB (Entity type "Province")

- United States (Entity type "Country")

Tip

The Cultural Hierarchy is a crucial component in the workspace to ensure error-free workflows. While it is not mandatory for all wells to be included in the hierarchy, any well that is not present will be automatically assumed to be in the United States.

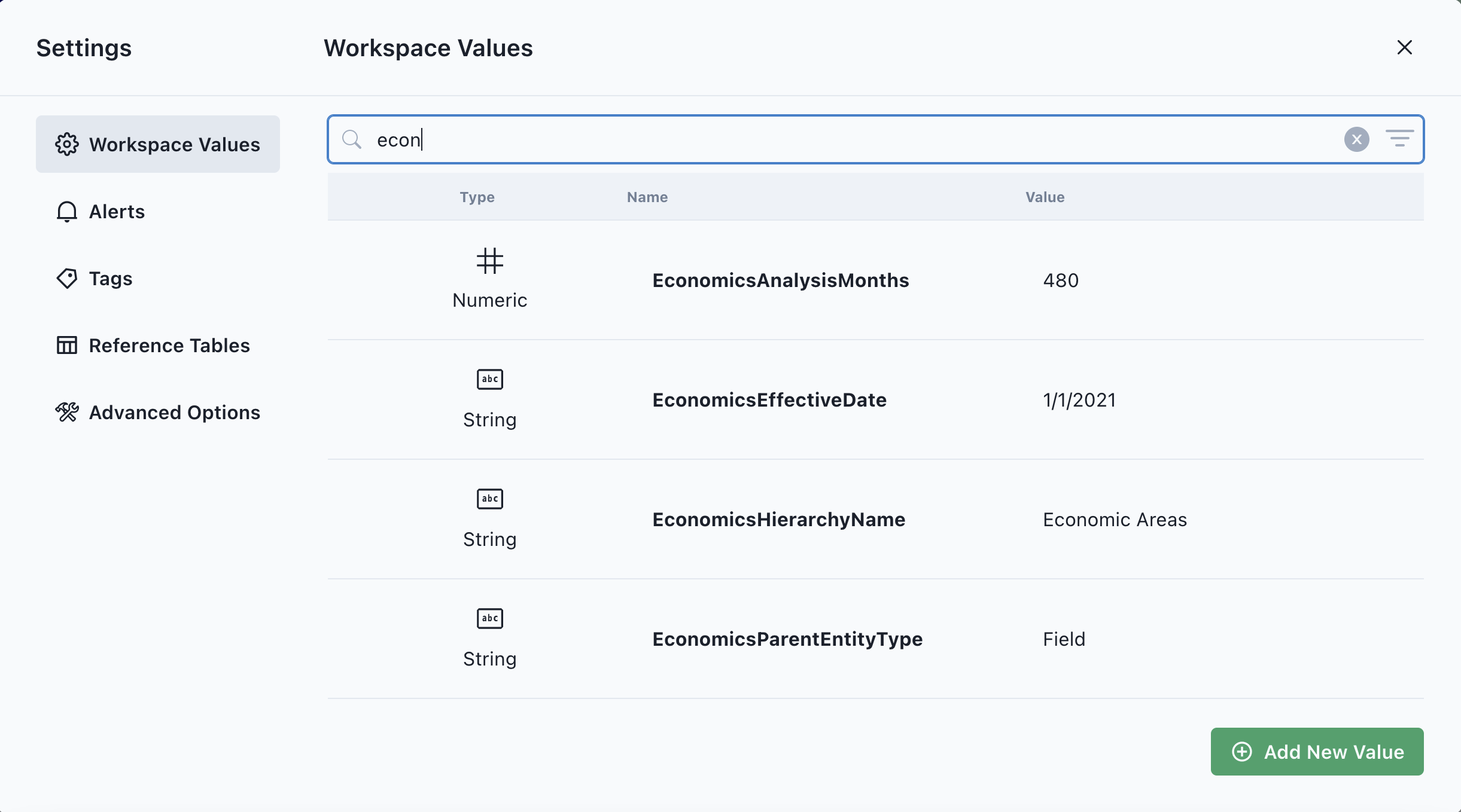

- Open the Workspace Values Editor by clicking on the settings icon, then set the following Work Space values:

- EconomicsEffectiveDate (format should be mm/dd/yyyy; will default to the current date if left blank)

- EconomicsAnalysisMonths (default is 480)

- EconomicsHierarchyName (This is the name of the hierarchy specified in the previous step)

- EconomicsParentEntityType (this is the type of entity that all wells have as a parent in the specified hierarchy; default is "Area")

- YearlyInflationRate (default is 0%)

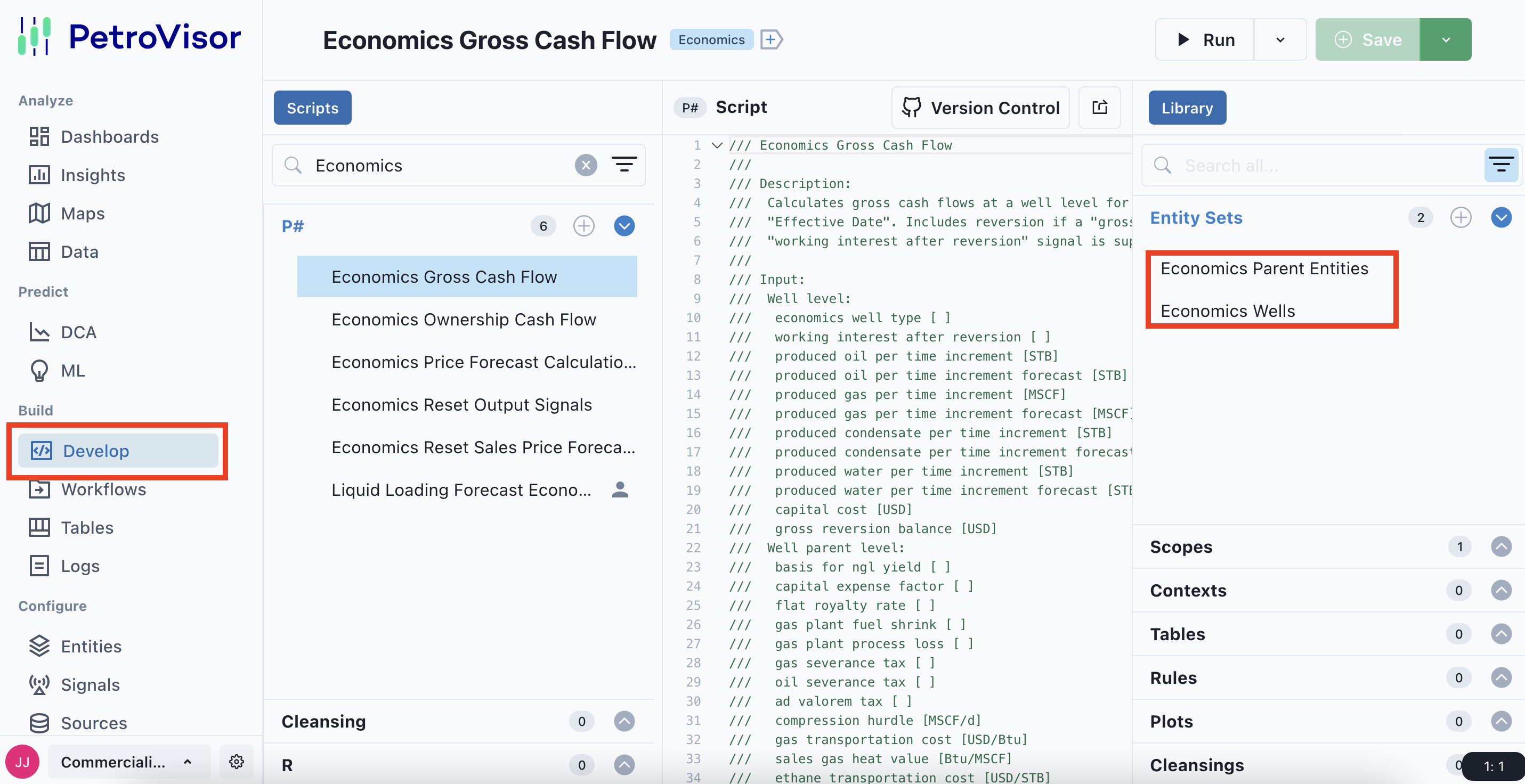

- Check that the Entity Sets “Economics Parent Entities” and “Economics Wells” contain the desired entities. Make any adjustments needed to the hierarchy.

- Ensure that production time signals (produced volume per time increment) and production forecast signals (produced volume per time increment forecast) are available for each well entity for which analysis is to be performed.

- Save hub price-forecast time signals (hub [oil/gas] price and hub [ngl] price fraction) to all well parent entities in the hierarchy. If you wish to use a flat pricing model, it is sufficient to simply enter the desired hub price or price fraction for the first month of the economics scope. This value will be carried forward automatically.

Caution

Ensure that the price forecast starts at the beginning of the economics scope (determined by the effective date).

Note

The sales price for each commodity will be calculated from the hub price as

sales price = (hub price * price factor) + price offset. The price factor and price offset are taken from the values of the signals "gas price factor", "liquid price factor", "gas price offset", "oil price offset" for the parent entities.

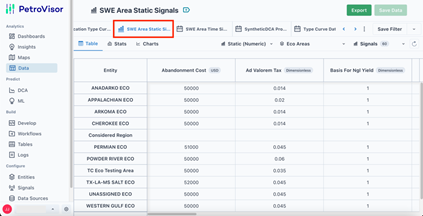

- Input all required static signals for parent entities. These are values that will be applied for all wells of that parent in the specified hierarchy. See the details section below for a list of all signals.

Tip

The simplest way to put in these values is by navigating to the Data Tab and selecting the “Economics Parent Static Signals” filter as shown in the image below.

Caution

Any of these signals left blank will be treated as having a value of zero

- Ensure that each well in the analysis has a value for the following signals:

- working interest before payout

- working interest after payout (if there is no reversion, this should be left blank)

- economics well type (by default, all wells will be treated as having type 0)

-

Well Type Signal Value Existing 0 Evaluation 1 Development 2 Rework 3 Farm-in Evaluation 4 Farm-in Development 5

-

- capital cost (only needed for new locations)

- allocated capital expenses per time increment (only needed for existing wells that have anticipated capital expenses)

- Ensure that all Canadian wells in the British Columbia province have a value for the following signals:

- british columbia gas type - Signal value should be one of the following: "Conservation" (meaning associated gas from oil production) or "Non-Conservation" (meaning non-associated gas produced by gas wells).

- british columbia gas base type - (non-conservation wells only) Signal value should be one of the following: "Base 9", "Base 12" or "Base 15".

- british columbia gas type - Signal value should be one of the following: "Conservation" (meaning associated gas from oil production) or "Non-Conservation" (meaning non-associated gas produced by gas wells).

-

- british columbia gas royalty reduction program - (non-conservation wells spudded before 1-Sep-2022 only). Signal value should be one of the following: "None", "Low Prod", "Marginal", "Ultra-Marginal", and "CBM".

- royalty framework british columbia - Signal value should be one of the following: "Current" (wells spud before 1-Sep-2022), "Transition" (wells spud between 1-Sep-2022 and 1-Sep-2024) or "New" (wells spud on or after 1-Sep-2024).

- british columbia oil vintage - Signal value should be one of the following: "Old", "New", "3Tier" and "Heavy".

- posted minimum price gas

- gas cost allowance

- Ensure that all Canadian wells in the Alberta province have a value for the following signals:

- alberta cost allowance

- custom processing fees

Caution

Cost allowance and custom processing fees are mutually exclusive; a well should have one or the other, but not both.

- If there are to be new locations included in the analysis, then ensure that the following reference tables have been filled out for each parent entity:

- Capital Expense Schedule for Development Wells

- Capital Expense Schedule for Evaluation Wells

- Capital Expense Schedule for Rework Well

-

Month FractionToExpense 1 0.28 2 0.67 3 0.05

Running the Workflow

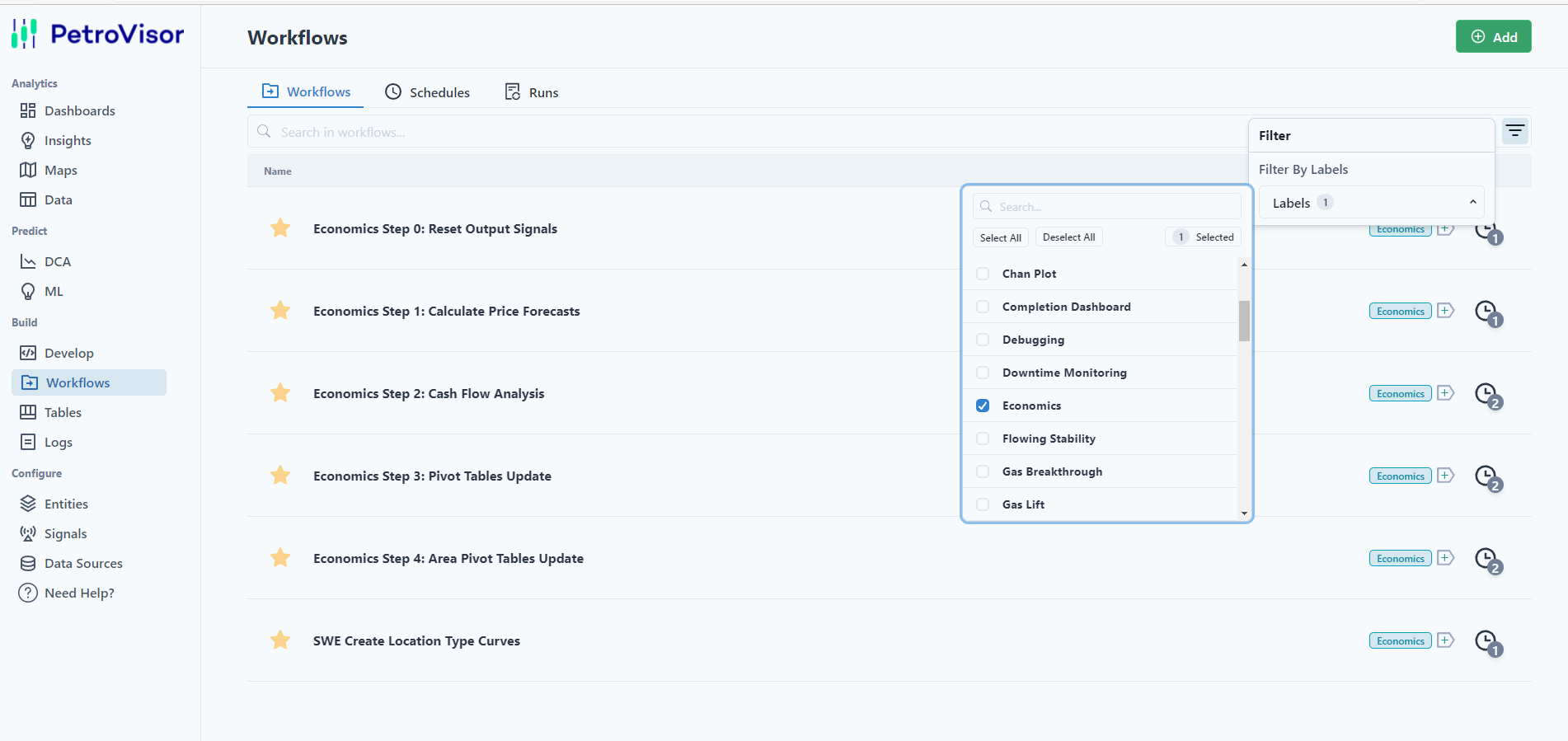

In PetroVisor, Select "Workflows." Use the filter at the right to filter to all workflows labeled "Economics." This filter will display the workflows associated with the Economics Package.

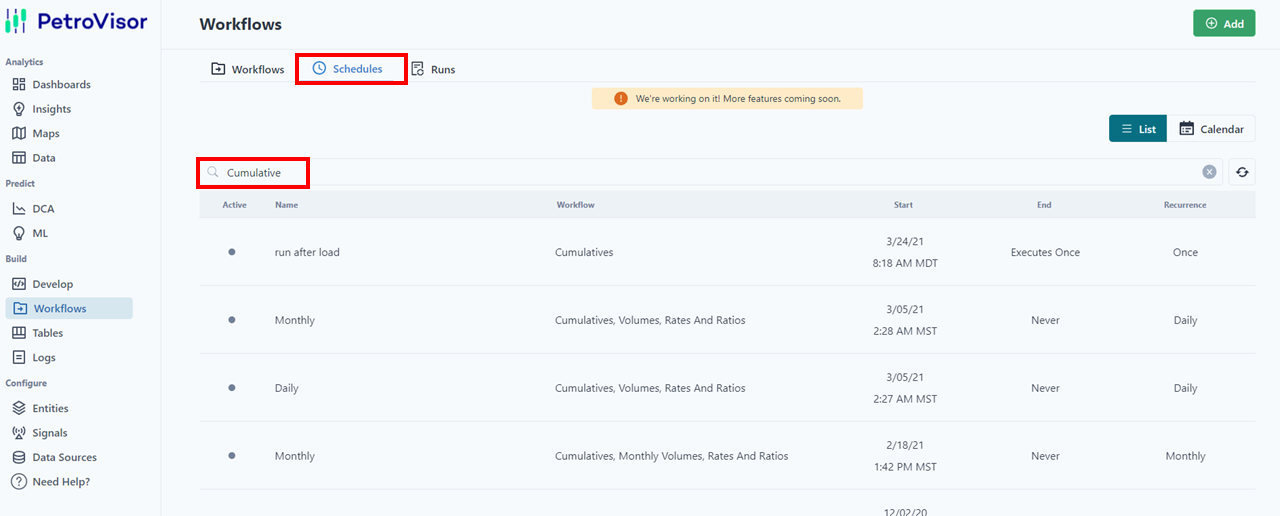

Workflow Packages normally have a schedule associated with the workflow. The schedule is viewed by selecting "Schedules" at the top of the page. To see the schedule for a specific workflow, use the search bar. Make sure that all schedules in the package are set to Active.

Begin executing the workflows included in the package by starting the included schedule "Economics Monthly Scope" for the workflow "Validate Economics Package".

Note

The Economics Package enables the Economic Summary Dashboards.

Details

The package includes the following series of workflows, which should be run in the order shown:

- Validate Economics Package

- Verify Economics Input Signals - Well Level

- Economics Reset

- Economics Gross Cash Flow Calculations

- Economics Ownership Cash Flow Calculations

- Economics Pivot Tables Update

- Economics Parent Pivot Tables Update

Data Requirements

The following data is required on well level:

economics well type [ ]

working interest before payout [%]

working interest after payout [%]

flat royalty rate [%]

produced oil per time increment [bbl]

produced gas per time increment [MSCF]

produced condensate per time increment [bbl]

produced water per time increment [bbl]

produced oil per time increment forecast [bbl]

produced gas per time increment forecast [MSCF]

produced condensate per time increment forecast [bbl]

produced water per time increment forecast [bbl]

gross reversion balance [USD] (only needed for existing locations with a remaining payout balance)

capital cost [USD] (only needed for new locations; will be multiplied by the value of the parent's "payout multiple" signal when determining reversion.)

Caution

Do not enter both a gross reversion balance and a capital cost for a single well. You should enter only one or the other or neither based on where it is an existing well or a future location.

The following data is required on parent level:

basis for ngl yield [ ] - A flag that determines how NGL yield will be handled:

Caution

Leaving this value blank will result in zero NGL volumes and expenses.

capital expense factor [ ]

abandonment cost [USD]

payout multiple [ ] (will default to 1.0 if not set)

gas plant process loss [ ]

gas plant fuel shrink [ ]

gas severance tax [%]

oil severance tax [%]

ad valorem tax [%]

compression hurdle rate [MSCF/d]

gas transportation cost [USD/MMBtu]

sales gas heat value [MMBtu/MSCF]

ethane transportation cost [USD/bbl]

propane transportation cost [USD/bbl]

butane transportation cost [USD/bbl]

pentane+ transportation cost [USD/bbl]

condensate transportation cost

oil transportation cost [USD/bbl]

ethane yield [STB/MSCF]

propane yield [STB/MSCF]

butane yield [STB/MSCF]

pentane+ yield [STB/MSCF]

condensate ethane content [%]

condensate butane content [%]

condensate propane content [%]

condensate pentane+ content [%]

condensate methane content [%]

evaluation well fixed monthly operating expense [USD]

development well fixed monthly operating expense [USD]

oil variable operating expense [USD/bbl]

gas variable operating expense (pre compression) [USD/MSCF]

gas variable operating expense (post compression) [USD/MSCF]

condensate variable operating expense [USD/bbl]

water variable operating expense [USD/bbl]

gas plant variable operating expense [USD/MSCF]

gas plant variable capital recovery expense [USD/MSCF]

start of production offset for development wells [ ]

start of production offset for evaluation wells [ ]

start of production offset for rework wells [ ]

yearly inflation rate [%]

liquid price factor [ ]

gas price factor [ ]

gas price offset [USD/MMBtu]

ethane price offset [USD/bbl]

propane price offset [USD/bbl]

butane price offset [USD/bbl]

pentane+ price offset [USD/bbl]

condensate price offset [USD/bbl]

oil price offset [USD/bbl]

hub oil price [USD/bbl]

hub gas price [USD/MMBtu]

hub ethane price fraction [%]

hub propane price fraction [%]

hub butane price fraction [%]

hub pentane+ price fraction [%]

hub condensate price fraction [%]